Customer journey maps are one of the most over-rated but under-utilized tools in the insurance industry. Most agents and marketers may already have a basic concept of what it is about.

But I think not everyone has utilized it enough to empower their sales process. And if you have come across any customer journey map for the life insurance sales process, chances are many of them are created by outsiders and look like any other templates – that do not address the real pain points of life insurance customers.

The aim of this article is to give you one of the most useful customer journey maps for a typical life insurance sales process. Instead of spending most of the time dressing it up, I will mainly focus on what kind of solution or content you (as an agent or marketer) should offer your prospects in each of the phases along the journey – eventually helping you to close more sales.

Also read:

What Do We Want to Get Out of a Customer Journey Map?

In its simplest form, a customer journey map allows you to visualize the many touchpoints your customers interact with your business.

Along the journey, they may encounter problems and pain points that create friction to pull them back. A well-laid-out customer journey map allows you to better understand your customer’s experience and identify ways to improve it.

That said, customer journey maps can help businesses to increase customer satisfaction, bring customer loyalty, and in return drive more sales and revenue.

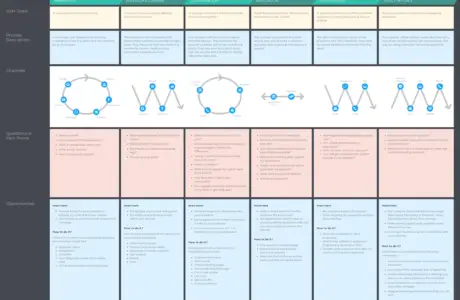

The components across each phase

To uncover the opportunities from the journey map, we will look at the six components in each phase, and they are:

- User’s goal

- Channels

- Questions or pain points

- Opportunities

- How to do it? (with suggested content)

For each phase, we will first identify the user’s goal. This can make sure we understand what needs to be done from the prospect’s perspective.

Then we will look at the channels a prospect will go through in the purchasing journey to complete his/her goal.

Next comes the obstacles that keep them from moving forward to the next phase. I will list out the questions (or pain points) a prospect may have during the process.

And eventually, we will identify the opportunities to improve the customer experience with suggested content to properly address their questions and pain points.

With the entire journey mapped out, you will never be clearer and certain of two things:

- What kind of content to share with or present to your prospects

- What you can do to build the relationship and increase the chance of closing

Done well, this will guide your prospects to move from one step to the next – and eventually, become a paying customer.

Are you ready? Let’s get started.

1. Awareness Phase

This is the very first step where a prospect realizes he/she has the need to shop for life insurance.

There are a handful of situations in life when one may need life insurance more than other times. The main reasons are the increase in liability as well as responsibilities at any time of their lives. Here are some of the critical occasions:

- Getting married

- Having a child

- Supporting aging parents

- Buying a house with a mortgage

- Taking out a loan

- Starting a business

- During a recession

- Becoming self-employed

- Becoming stay-at-home parents

Related post:

20 Life Insurance Blog Topics to Boost Your Web Traffic

User’s goal: Your prospects would like to understand how your plan works for his/her situation.

Channel: Like most purchases, most people will search on Google or YouTube for quick answers. Personal finance websites may also come in handy. Some may also reach out to their own networks, through messaging apps or phone calls.

This phase is non-linear, meaning the user may jump from here to there and may look back and forth, without following a particular sequence.

Questions or pain points:

- How does life insurance work?

- How many different types of life insurance are there?

- What is covered and what is not?

- How much should I spend?

- How much coverage should I get?

- Can I cancel anytime?

The questions (or pain points) are actually the best cues for creating content. If these questions are well addressed, you help them move forward to the next phase of the journey.

You may be interested in:

Top 10 Life Insurance Blogs That Are Actually Interesting to Read

Top Insurance Blogs for Insurance Marketers to Follow

Opportunities

Keep in mind that this is the initial phase of the entire purchase journey. And your goal as a sales representative/marketer is to make a good impression on your prospects at every touchpoint possible – with the most helpful content that they can trust.

Important:

- To make it easy for your prospects to discover your brand and your content

- Concentrate on answering their questions in this phase

How to do it?

Short-form content that answers their questions directly will do the job well:

- Explainer videos

- Infographics

- Short blog posts (e.g. checklists, guides, or how-tos)

- FAQs

2. Research and Comparison Phase

Next, enters the research and comparison phase, also known as the information-gathering phase.

A prospect is going to consume longer forms of content across a few different brands. The idea is to get a better understanding of the brands, the products, and the service – to make an informed decision.

User’s goal: To research for and compare different options (usually more than 3 brands) in the market.

Channels: Search engine, personal finance blogs, insurance comparison sites, online forums (e.g Reddit, Quora, Facebook groups, etc)

Questions or pain points:

- Are insurance comparison websites legit?

- What aspects should I be looking for in a plan?

- How much coverage should I get?

- How much is life insurance?

- What will affect the premium?

Other than the coverage and term, here are some facts that will affect the premium:- Age

- Gender

- Health conditions

- Family medical history

- Smoking status

- Drinking habit

- Occupation

- Lifestyle (e.g. frequent travel)

- Hobby (e.g. riding a motorcycle)

- Payment mode (e.g. monthly or annual)

- Should I buy on price?

Opportunities

As the prospect is now navigating through different brands, agents/marketers should try to engage with them by providing additional information about their products and services with the goal to:

- Highlight your unique selling point

- Build trust and show authority within your domain

- Share customer success stories

How to do it?

It’s important to win your prospects’ trust by showcasing your expertise in the insurance domain. One way is to convince them that you and your brand are resourceful enough to help them solve their problems, and eventually save their time and money.

There are a few tactics you can apply:

- Education on buying insurance

- Let visitors sign up for emails that give them insurance tips

- Highlight the unique selling proposition of your brand or products

Most shoppers think life insurance is 3Xs the actual cost

2020 Insurance Barometer Study by LIMRA

Here are the types of content you may use to serve these purposes:

- Blog posts (e.g. response posts that answer a question)

- Explainer videos to answer life insurance questions

- Product comparison tables

- User reviews

- FAQs

Also read:

20 Life Insurance Blog Topics to Boost Your Web Traffic

20 Sad Facts and Stats About Life Insurance

For example, Quotacy has a Video Q&A section on their website where they cover everything from researching what type of life insurance policy to buy to how to get the best prices for coverage.

3. Consideration Phase

Also known as the “evaluation” phase, here your prospects narrow down their selection to 2-3 brands.

They know these brands can solve their problem or provide what they need. But they are still weighing if one brand is better than the other for his particular situation.

User’s goal: To evaluate 2-3 options. Attempt to choose the best among them.

Channels:

- Insurers’ websites or social media (e.g. Youtube or Twitter)

- Social media groups

- Insurance comparison websites

- Insurance reviews websites

- Personal finance websites

- Online forums

It all boils down to the marketing approach of your brand. See these posts below if you want to better understand how to target a specific segment of customers:

- How to Market Insurance to Millennials Online? (8 Tips You Must Know)

- How to Market Insurance to Gen Z

- 50 Quick and Easy Facebook Marketing Ideas for Insurance Agents Without a Website

- 8 Facebook Marketing Mistakes Insurance Agents Should Avoid (and How to Fix Them)

Questions or pain points:

- What is covered and what is not?

- Will my premium increase over time?

- What is the difference between a term/whole life policy?

- Can I withdraw cash from a policy?

- Is the premium of life insurance refundable if I don’t die?

- Will a life insurance company go bankrupt?

- Should I buy through an insurance agent or online? What’s the difference?

Opportunities

The good news is, these questions can initiate some interesting conversions easily. And it is the best time to show your expertise and build trust with your prospects by providing your best answers.

Important:

- Appeal to the emotion: Harvard Business School professor Gerald Zaltman says that 95% of our purchase decision-making takes place subconsciously.

- Retain a human touch: talk and listen to your prospects as much as possible. After all, life insurance involves feelings and emotions, people are more likely to connect to someone who will understand and care for their feelings.

- To build a long-term relationship with your prospects, even if they decide not to buy

- Be transparent and let them know what it is like to be a customer. You can share your customer success stories or testimonial

How to do it?

This is the closest step you can move a prospect to a customer.

One of the best ways for a customer to experience your complex product (e.g. insurance is one to most people) is by sharing a customer story. Studies have proven that a story activates the region of the brain that processes sights, sounds, tastes, and movement. (Source: Neuroscience Confirms We Buy on Emotion & Justify with Logic & yet We Sell to Mr. Rational & Ignore Mr. Intuitive)

More often than not, they may just need someone to give them encouragement or remove that obstacle for them.

As a rule of thumb, give them a human touch and make communication channels available. These are some communication channels you might use:

- Live chat channel from your website

- A phone number that connects to a sales or CS rep

- Instant messages through social media

- Email contact point/newsletter signup form

- Simple booking widget for a video chat or face-to-face meeting on your website

Life insurance is a commitment and takes time to consider. Continue to nurture the relationship if the prospect is not ready to convert at one time.

You can even tease the prospect with current promotions or offers.

Here are some BOFU (bottom-of-funnel) collaterals that you can utilize to nurture that relationship:

- Customer interviews

- Customer success stories/testimonials

- Client case studies

- Product landing pages

- Service demo/walkthrough

- Discount offer

4. Application Phase

During the application phase, the prospects will fill out the application form and complete the payment process.

Depending on the situations and requirements of the carriers, clients may have to fill in health-related answers that could affect the underwriting result.

User’s goal: They have made the decision to buy, so they just want to get the application form completed as quickly as possible and get covered.

Channels: Face-to-face meeting is the most common form. Website or apps are also used for the online channel. But your customers may need to have assistance through a live chat and a phone call.

This is a linear or step-by-step process. The agent should aid the customers to complete the form as much as they can. Or if it is an online context, customers should be able to get real-time support if needed.

Questions or pain points:

- How long will the process take?

- What kind of health information will they ask for?

- Do I need a medical examination to qualify for coverage?

- What’s the next step after I submit my application?

- Under what circumstances will my application be declined?

- What are the payment options?

- Is there any discount?

Opportunities

Although some companies are really striving to make the life insurance process as quick and carefree as possible, on average, it still takes about 3-8 weeks.

Important:

- Make it simple and don’t let the customer think too much

- Set expectations: State clearly how long will the application take and how many steps are there in the process

How to do it?

- Setup a simple and intuitive application process

- Make live chat or phone number easily available during the entire process

5. Underwriting Phase

Just because your customer has submitted the application and paid the premium does not mean the customer experience should end here.

In fact, this phase could be uncertain for some customers as underwriters may sometimes need to ask further questions based on the application.

The insurer will determine whether they would accept this application. The time for the process will depend on a basket of factors.

There are three possible outcomes resulting from this phase:

- Acceptance: The application is approved based on the amount/coverage applied for.

- Decline: The insurer rejects the application if based on age, pre-existing diseases, or hazardous job positions.

- Adjustment of coverage: One of the common practices is that the insurer will add an exclusion provision within the policy. That means it will eliminate coverage for specific treatments or diseases. This usually applies to pre-existing conditions such as illness or injury.

User’s goal: To get the updated status of the submitted application, and get approved as soon as possible

Channels: Email, in-app messages, phone calls

Questions or pain points:

- How long does the application process take?

- Can I check the status of my application?

- What are their criteria for approval?

- Can I still get insurance from another provider if I am declined?

Opportunities

This could be the most frustrating phase of the entire journey. Imagine you have paid for something and are not sure when, or even whether you will get the benefit of it.

And to make it worse, insurers usually keep the process in a black box and customers have no idea of who will look at the application, and how the application is being accessed.

At times, additional information might be needed from the underwriters. And this will create friction and slow down the process.

Important

- Be transparent about the process

- Show empathy, be supportive, and care about feelings

How to do it?

- Send timely updates on application progress (e.g. by emails or SMS)

- Provide contact points so that clients can reach out if they have questions

6. Policy In-Force Phase

Hooray! You’ve come a long way. The application is now accepted and the prospect has become a customer.

Although the policy issuance is an update of status or just an incident, I name this as the policy in-force “phase” because things don’t stop from here.

Instead, an agent could create a delightful onboarding experience for the new relationship. And from this point, they should continue to serve the client the best they can as long as the policy is in force. I will show you how in the following.

User’s goal: To be assured that it is exactly the coverage he applied for.

Channels: Email, SMS or a letter.

Questions or pain points:

- What should I do with my policy?

- Should I read through all the provisions or terms and conditions pages?

- Where is the contact information if I need help with policy servicing or claims?

- What after-sales service will I get?

- What if I lose my policy?

Opportunities

Again, this is the beginning of a new relationship. Your goal as an agent/marketer should be servicing your customers for the years to come.

Important:

- Don’t assume they’ve already understood every single detail of the policy at this point – keep educating them about their coverage

- Make service support easily available across different channels

- Continue to build a long-term relationship with your customer

How to do it? (with suggested content)

Although some carriers still call their client policyholders and don’t contact them beyond policy anniversaries, some carriers have evolved to become health or lifestyle partners for their clients.

Technology, mobile devices, and wearables have made it much easier for insurers to engage with their customers with more meaningful touchpoints.

Take Vitality as an example. It is an insurance loyalty program with 10 million members across 22 markets, developed by a South African company called Discovery Limited.

They have created a rich reward program that incentivizes a healthy lifestyle and is based on behavioral economics. Examples may include having a medical checkup or taking a certain number of steps in a month.

Here are some ideas you can offer to your customers right after the policy has been issued:

- A welcome pack to explain what is covered and what is not

- Summary of their coverage (e.g. infographics)

- Health-related tips (e.g. checklists) or offerings (e.g. discounts on sports apparel or fitness classes)

- Email newsletters, or videos to educate them about their coverage

- Assigned service agents or hotline they can call 24/7

Conclusion

There you have it, by going through the components (user’s goal, process, channels, questions or pain points, and opportunities, and how to do it) of each phase, you can see a clear picture of the many touchpoints in the customer journey for life insurance.

Having a good idea of your customer’s questions or pain points will help you understand exactly what kind of content to use, and how to integrate them into your sales process.

Hopefully, with this customer journey map, you can easily add meaningful touchpoints and create effective marketing strategies that delight and convert your customers in no time.