If you’ve searched for customer journey maps for health insurance on the internet, chances are the results may make you even more frustrated than ever. Why? Most of them only focus on how to build a customer journey map that looks nice and stops there.

Very few actually tell you what to do with the map itself – to solve the pain points of your customer at every phase along the customer journey.

To bridge this gap, I set the goal to continue from what most people left off. And in this post, I will show you how to uncover opportunities from an online purchasing journey to increase touchpoints, develop helpful content and improve customer experience.

By the time you finish reading, you will know exactly what kind of content and strategies you can implement along the customer journey to move a prospect towards a conversion more effectively.

Also read:

What Is a Customer Journey Map?

But before we dive into the details, let’s have a quick warm-up. So what is a customer journey map?

According to HubSpot, a customer journey map is a visual representation of the process a customer or prospect goes through to achieve a specific goal of their own. With the help of a customer journey map, you can get a sense of your customers’ motivations — their needs and pain points.

What Do We Want to Get Out of a Customer Journey Map?

A customer journey map allows you to visualize the many touchpoints your customers interact with your business.

Along the journey, they may encounter problems and pain points that create friction to pull them back. A well-laid-out customer journey map allows you to better understand your customer’s experience and identify ways to improve it.

Customer journey maps can help businesses to increase customer satisfaction, bring customer loyalty, and in return drive more revenue.

The Online Health Insurance Purchasing Journey

In this article, I will walk you through the journey of purchasing a (private) health insurance plan online. The customer will interact with the insurer mainly through online channels.

The online journey

Your website (or sometimes a mobile app) is your storefront or the primary channel.

Traffic will come from organic search, PPC, social media, your email marketing campaigns, or referrals from insurance comparison websites.

Just because it is an online journey does not mean you should only limit yourself to online channels only. After all, insurance is a business for humans and it can’t be completed without the human touch.

From time to time, your potential customers may also need to talk to a person via telephone or meet a sales or customer service rep in person.

ALSO READ:

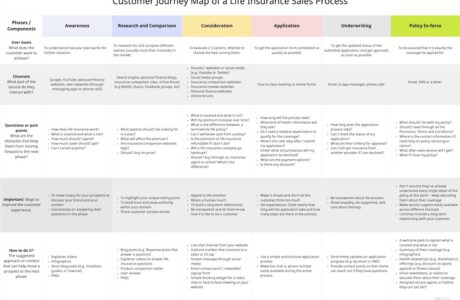

The six phases in the purchasing journey

To tailor for the context of an online health insurance application, we will put the purchasing journey in six phases. And they are in order of:

- Awareness Phase

- Research and Comparison Phase

- Consideration Phase

- Application Phase

- Underwriting Phase

- Policy In-Force Phase

While most journey mapping tutorials require you to select a persona to target a specific segment, we will leave it open here and try to make most of the points applicable to all customers in general.

The six components across each phase

To uncover the opportunities from the journey map, we will look at the six components in each phase, and they are:

- User goals

- Process

- Channels

- Questions or pain points

- Opportunities

- How to do it? (with suggested content)

For each phase, we will first identify the user goals. This can make sure we understand what needs to be done from the prospect’s perspective.

Then we will look at the process and channels a prospect will go through in the purchasing journey to complete his/her goal.

Next comes the friction that keeps them from moving forward to the next phase. I will list out the questions (or pain points) a prospect may have during the process.

And eventually, we will identify the opportunities to improve the customer experience with suggested content to properly address their questions and pain points.

With the entire journey mapped out, an insurance marketer will never be more clearer and certain of what kind of content to produce or channels to include at each phase of the purchasing journey.

Done well, this will guide your prospect to move from one step to the next – and eventually become a paying customer.

So, let’s get started.

1. Awareness Phase

First and foremost, the awareness phase begins when a prospect realizes or starts to realize he/she has the need to shop for insurance. The common trigger point may be reaching a certain age (for private insurance) or the open enrollment period (for ObamaCare).

User goals: Your prospect would like to understand how your plan works for his/her situation.

Process: In this phase, your prospects are checking multiple channels (e.g. online and own network) for quick answers.

This phase is non-linear, meaning the user may jump from here to there and may look back and forth, without following a particular sequence.

Channel: For an online journey, a prospect may search in Google or check the company’s website for answers. They may also reach out to their own networks, through messaging apps or phone calls.

Questions or Pain Points:

- Where should I start?

- How does health insurance work?

- What is covered and what is not?

- What are my options?

- How much should I spend?

The questions (or pain points) are actually the best cues for creating content. If these questions are well addressed, you remove their obstacles and let them move forward to the next phase of the journey.

Opportunities

Keep in mind this is the initial phase of the entire purchase journey. And your goal as a marketer is to make a good impression on your prospects at every touchpoint possible – with the most helpful content that they can trust.

Important:

- To make it easy for your prospects to discover your brand and your content

- Concentrate on answering their questions in this phase

How to do it?

Short-form content that answers their questions directly will do the job well:

- Explainer videos

- Infographics

- Short blog posts (e.g. checklists, guides, or how-tos)

- FAQs

Check out these examples from online insurers:

- Health Insurance 101: A Comprehensive Guide to Health Insurance – eHealth Insurance

- Your Guide to Open Enrollment [Video] – Oscar

- How To Baby-Proof Your Health Insurance Checklist – GoHealth

To increase your exposure, you may also need to use PPC on Google, Youtube or Facebook to direct your prospect to your content.

2. Research and Comparison Phase

This is the information-gathering phase. A prospect is going to consume longer forms of content to get a better understanding of your brand, your products, and your service.

User goals: To research for and compare different options in the market.

Process: This could be an iterative process that demands the prospects to shortlist the right plans. They may jump from one channel to another for more in-depth product information available out there.

Channels: Search engine, insurance comparison sites, online forum (e.g Reddit, Quora, Facebook groups, etc)

Questions or Pain Points

- What aspects should I be looking for in a plan?

- What will affect the premium?

- Are insurance comparison websites legit?

- Should I buy on price?

Opportunities

Important: As the prospect is now navigating through different brands, marketers should try to nurture and engage with them by providing additional information about their products and services.

- To highlight your unique selling point

- To build trust and show authority within your domain

How to do it?

It’s important to win your prospects’ trust by showcasing your expertise in the insurance domain. Convince them that you and your brand are resourceful enough to help them solve their problems, and eventually save their time and money.

There are a few tactics you can apply:

- Make online quote easily available

- Highlight the unique selling proposition of your brand or products

- Let visitors sign up for emails that give them insurance tips

- Re-target visitors to your site with Facebook ads

Here are the types of content you may consider producing:

- Blog posts (e.g. Response posts that answer a question)

- Product comparison tables

- User reviews

- FAQs

ALSO READ:

3. Consideration Phase

Also known as the “evaluation” phase, here your prospects narrow down their selection to 2-3 brands. They know these brands can solve their problem or provide what they need. But they are still weighing if one brand is better than the other for him/her in particular.

User goals: To evaluate 2-3 options. Attempt to choose the best among them.

Process: Your prospect will need cues to make an informed decision. They will check the provider’s website, ask questions in online forums or social media groups, read online reviews, or talk to their friends and family. They may even try to get in touch with the insurers with a chatbot or directly talk to their sales reps.

Channels:

- Insurers’ websites

- Comparison websites

- Insurance reviews

- Online forums

- Social media groups

- Phone calls

Questions or Pain Points

- What is covered and what is not in a plan?

- Should I really buy online or through an insurance agent? What’s the difference?

- How do I know if an insurer actually pays out claims?

- Is their CS helpful?

- What kind of support do I get if I need to file a claim?

- How long does it take to get reimbursed?

- Can I appoint someone else to take care of my claim if I get really sick?

Opportunities

Ideally, this phase will lead to a conversion. So you will want to differentiate your brand by showing your prospects what makes you different and what you do best.

This may include guiding them to the next phase with supporting materials that show the benefits of being your customers.

Important:

- To build a long-term relationship with your prospects

- Be transparent and let them know how it is like to be a customer

- Motivate your prospect with the benefits of your products/services

How to do it? (with suggested content)

This is the closest step you can move a prospect to a customer. More than often, they just need someone to give them encouragement or remove that obstacle for them.

As a rule of thumb, give them a human touch and make communication channels available. These are some communication channels you might use:

- Live-chat on your website

- Display a phone number that connects to a sales or CS rep

- Instant message through social media

- Email contact point

- Simple booking widget for a video chat or face-to-face meeting on your website

Continue to build the relationship if the prospect is not ready to convert at one time. You can tease the prospect with future promotions or insurance tips. This can be done by setting up a simple web form to let them opt in.

Here are some BOFU (bottom-of-funnel) examples to facilitates the conversion:

- Customer interviews

- Testimonials

- Product landing pages

- Service demo/walkthrough

- Client case studies

- Discount offer

- Email newsletters

ALSO READ:

4. Application Phase

With the application phase, the prospects will become your customers by filling out the application forms and completing the payment.

This should be the shortest phase of the entire purchasing journey. Instead of asking the client to fill in a 39-pages application form, online insurers are already reinventing the process by making it simple, easy, and frictionless. To learn more, check out this wonderful post from JRNY: 10 Ways to Improve the UX Conversion Rate of Insurance Form

User goals: To get the application form filled as quickly as possible and get covered.

Process: This is a linear process that should be simple, easy, and secured. Customers should be able to get real-time support if needed.

Channels: Website or apps are commonly used for the online channel. But your customers may need to have assistance through a live chat and a phone call.

Questions or Pain Points:

- How long will the process take?

- What kind of health information will they ask?

- Do I need a medical examination to qualify for the coverage?

- What’s the next step after I submit my application?

- Under what circumstances will my application be declined?

- What are the payment options?

- Is there any discount?

Opportunities

Although some companies are really striving to make the life insurance process as quick and care-free as possible, on average, it still takes about 3-8 weeks.

If you can simplify your application process and reduce the approval time to less than 3 weeks, you are already ahead of the pack.

Important:

- Make it simple and don’t let the customer think too much

- Set expectations: State clearly how long will the application take and how many steps are there in the process

How to do it?

- Use clear product quotation page

- Setup a simple and intuitive application process

- Make live chat or phone number easily available during the entire process

5. Underwriting Phase

This phase begins with the customer submitting the application. The insurer will determine whether they would accept this application. The time for the process will depend on a basket of factors.

Let’s say for private medical insurance, the applicant’s age, his/her own and family medical history, or amount of protection (e.g. annual or lifetime limit of the policy) will all affect the processing time.

There are three possible outcomes resulting from this phase:

- Acceptance: The application is approved based on the amount/coverage applied for.

- Decline: The insurer rejects the application if based on age, pre-existing diseases, or hazardous job positions.

- Adjustment of coverage: One of the common practices is that the insurer will add an exclusion provision within the policy. That means it will eliminate coverage for specific treatments or diseases. This usually applies to pre-existing conditions such as illness or injury.

User goals: To get the updated status of the submitted application, and get approved as soon as possible

Process: The client has literally no control at this phase but wait. The underwriter may need to request additional information from the client.

Channels: Email, in-app messages, phone calls

Questions or Pain Points

- How long does the application process take?

- Can I check the status of my application?

- What are their criteria for approval?

- Can I still get insurance from another provider if I am declined?

Opportunities

This could be the most frustrating phase of the entire journey. Imagine you have paid for something and not sure when, or even whether you will get the benefit of it.

And to make it worse, insurers usually keep the process in a black box and customers have no idea of who will look at the application, how the application is being accessed. At times, additional information might be needed from the underwriters. And this will create friction and slow down the process.

Important

- Be transparent about the process

- Show empathy, be supportive and care about feelings

How to do it?

- Send timely update on application progress (e.g. by email or SMS)

- Provide contact points so that client can reach out if they have questions

6. Policy In-Force Phase

Hooray! You’ve come a long way. The application is now accepted and the prospect has become a customer.

Although the policy issuance is an update of status or just an incident, I name this as the policy in-force “phase” because things don’t stop from here.

Instead, the insurer could create a delightful onboarding experience for the new relationship. And from this point, they should continue to serve the client the best they can as long as the policy is in force. I will show you how in the following.

User goals: To be assured that it is exactly the coverage he applied for.

Process: The customer will be notified, usually attached with a copy of the insurance policy with the provisions, that they are being covered for what they applied for.

Channels: Email, SMS or a letter.

Questions or Pain Points

- What should I do with my policy?

- Should I read through all the Provisions, Terms and Conditions?

- Where is the contact information if I need help on policy servicing or claims?

Opportunities

Again, this is the beginning of a new relationship. Your goal as a marketer should be delighting your customers for the years to come.

Important:

- Don’t assume they’ve already understood every single detail of the policy at this point – keep educating them about their coverage

- Make service support easily available across different channels

- Continue to build a long-term relationship with your customer

How to do it? (with suggested content)

There are many ways to create more touchpoints to engage with them. You don’t have to wait until a claim or the month before the policy anniversary to contact your customers. Here are some ideas you can offer to your customers right after the policy has been issued:

- A welcome pack to explain what is covered and what is not

- Summary of their coverage (e.g. infographics)

- Health-related tips (e.g. checklists) or offerings (e.g. discount on sports apparel or fitness classes)

- Email newsletters, or videos to educate them about their coverage

- Assigned service agents or hotline they can call 24/7

You may also like:

Insurance Email Marketing: 10 Referral Email Templates You Can Use

Insurance Email Marketing: 12 Personalization Ideas You Must Know

How to Create Personalized Customer Experience for the Insurance Industry?

Conclusion

Hopefully, by going through the components of each phase, you can see the full picture of the online purchasing journey for health insurance in particular.

By having a good understanding of your customer’s questions or pain points, you’ll know exactly what kind of content to develop and how to integrate them into the equation. With this journey map, you can easily increase touchpoints and create effective marketing strategies that delight and convert your customers. And with happy customers, more business will come through the door.

Further Readings

- What is Customer Journey Map? (Visual Paradigm)

- How to Create an Effective Customer Journey Map [Examples + Template] (HubSpot)

- Use This Customer Journey Mapping Template to Identify Marketing Gaps (Alexa Blog)

- What’s the Right Content for Each Stage of the Marketing Funnel? (Single Grain)

- Customer Journey Maps: The Top 10 Requirements (Heart of Customer)

- Customer journey map templates: 6 examples to inspire you (Ring Central)

- 15 Powerful Customer Journey Maps (Primary Intelligence)