Most people think homeowner’s policies only cover things like fur coats, gold bullion, stock certificates, or things that may be more relevant to our parents or grandparents.

As for consumers today, they want additional coverage for home electronics or mobile devices. In fact, one out of five Americans works from home now. So they want to know that they have proper coverage if they happen to work from home.

Hippo takes that modernization with a customer-centric approach – with everything from onboarding the customer, the application process, getting the policy all the way through the coverage itself.

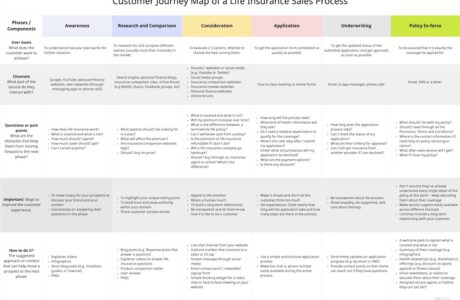

|

About Hippo Hippo was founded in 2015, launched in 2017. And in 2020 the insurtech company has raised $150 million Series E funding, bringing its valuation to $1.5 billion. Hippo is now available in more than 30 states. According to Crunchbase, Hippo has a recorded sales growth of 60 percent year-over-year in Q2 of 2020, as many people stayed home amid the COVID-19 pandemic. Over the last year, the company’s written premiums grew to $270 million, representing 140 percent year-over-year growth. |

This article is an excerpt from an interview with Rick McCathron, Chief Insurance Officer of Hippo Insurance, by Igrani Hugh. You can listen to this interview from Insurance Influencers podcast by Accenture.

Who Should Read This Article?

Whether you are in insurance or insurtech, an entrepreneur in any industry, a product manager, a growth manager, a marketer, or a UX designer, you will find something for you from Hippo’s story.

This is by no means a word-to-word transcription. And I will only include here the parts that are related to their customer-centric approach.

What Is A Customer-Centric Approach?

Customer-centric approach is a business strategy that is based on putting customer’s interest first at the core of a business. It is done by reaching out to customers proactively, providing good customer experience and building long-term relationships.

What Problem Is Hippo Trying to Solve?

According to Richard, Hippo has a vision to help people with things that are somewhat complex, but are so important in their everyday life.

For instance, there are some companies that have done a pretty good job in modernizing auto insurance with a streamlined process – from getting a quite to buying the policy. It’s a simple process that most people understand because they have had car insurance for a long time.

Homeowner’s insurance, however, is a much more complex product in contrast. There are a lot of different factors to consider related to where it is, how it’s made, and so on. Or whether it is in an area where you’re prone to catastrophic exposures like flood or earthquake or hurricane tornado.

So, it is a much more complex process that most people don’t really understand. They believe that helping with homeowner’s insurance would do the most good – to provide value to its customers.

How to Build A Customer-Centric Insurance Company?

Based on the interview by Accenture, we have identified 5 building blocks Hippo put into practice to make it happen. And they are:

- Making It Easy for The Customers Right Up Front

- Adding Value With Data

- Proactively Building Long Term Relationship with Customers

- Building Trust With Customer As A New Brand

- Creating Products That Customers Want

Let’s look into them one at a time.

Building Block 1 – Making It Easy for The Customers Right Up Front

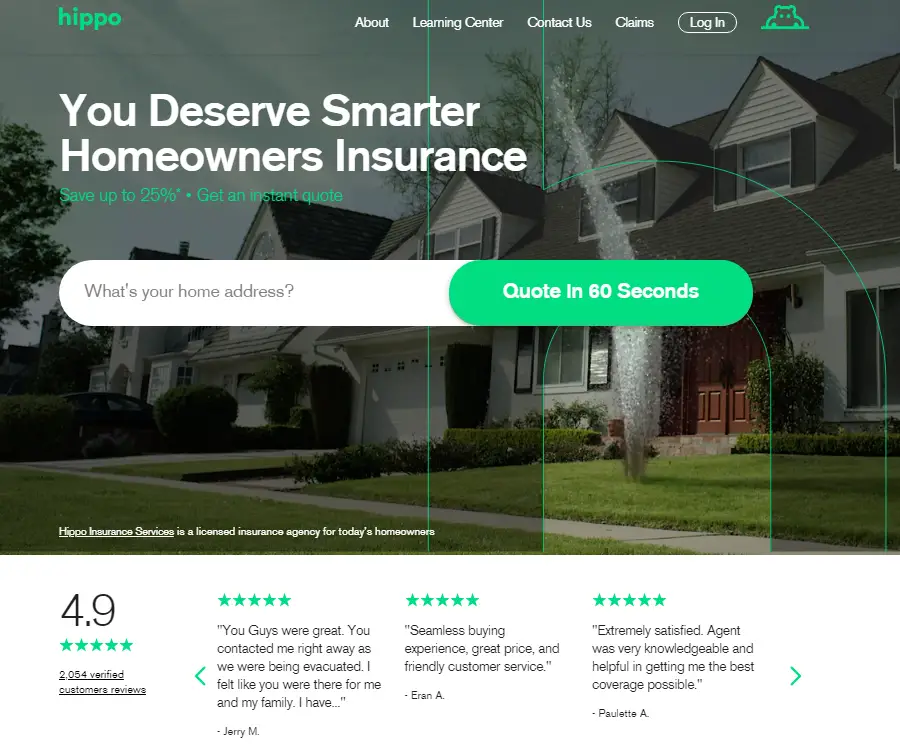

On Hippo’s website, all you need is to input your address, answer a few basic questions and you can get a quote within 60 seconds.

And on the other hand, with a traditional provider of homeowner’s insurance, you’ll generally talk to an agent for over an hour. And through that process, they will follow up with somewhere between 80 and 130 questions about the address you provide.

The difference with Hippo is, the second they have that address, they will go to multiple data providers and get questions answered about your house that are publicly available. Thus, they can skip asking questions that a customer might not even have an answer to.

Not only are they removing that question and removing that friction, but they are also getting more accurate answers from different data sources. It’s a win-win for both sides.

Building Block 2 – Adding Value With Data

And on top of that, they are adding value to the customers by making sense of the data they acquired. Here’s how they do it:

Allowing customer to input the data

A mechanism was developed to allow their customers to correct the information if they’ve found the data in Hippo is incorrect. Therefore, they are always welcome to input to the system with more accurate information.

Making sure customer are well protected

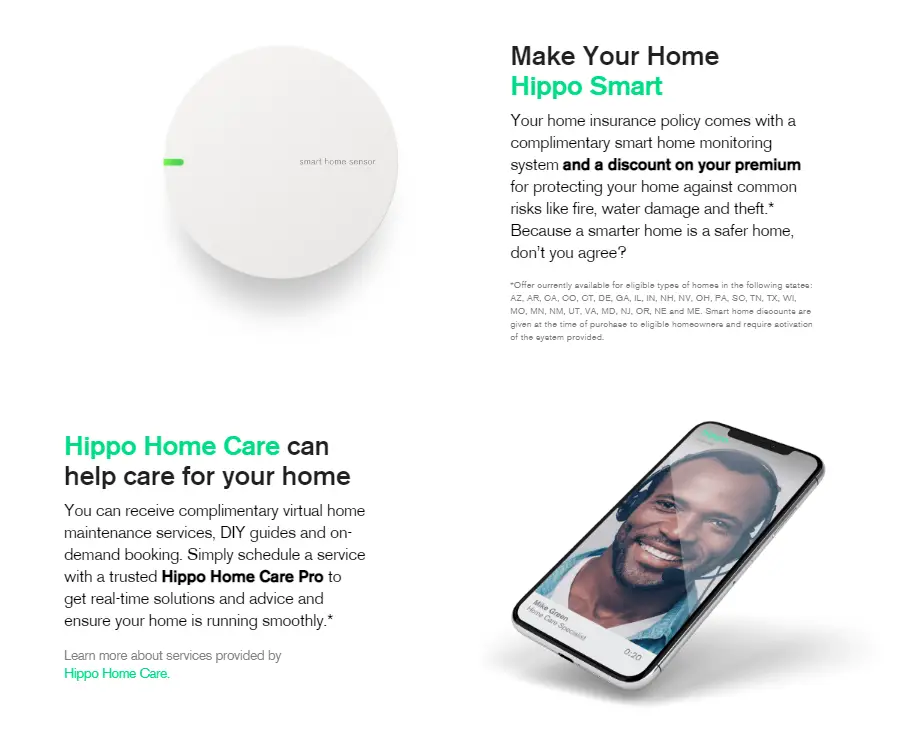

Hippo uses high definition, aerial imagery of the house as one of their unique ways to get their data. With these images, they are able to assess how big the house is, the age and condition of the roof, or whether there is heat escaping from the house, and so on.

They can also spot things like a new swimming or a trampoline. And then they’ll talk to them to make sure that they have the appropriate coverage.

So, when the neighborhood kids are coming over and something happens to one of the children , the customer are able to make sure that they are well protected.

Keeping data fresh

One of the major rating components for homeowner’s insurance depends on the age and condition of a roof.

People do replace their roof. But very few of them would reach out to their insurance company they actually did. For Hippo, when they get a refresh of their data,they’ll notice that the roof was replaced. They will reach out to their customers, verify that they have their roof replaced.

And when it comes to the next renewal, Hippo will give them a discount on their policy because they have a brand-new roof.

It’s that proactive, ongoing relationship that ensures that customers are well-protected as their life changes.

Building Block 3 – Proactively Building Long Term Relationship with Customers

Whether it’s one year, five years, 10 years or 20 years, their approach is to reach out however they can to build good relationships with their customers. And that goes all the way through the claims process. Here are two of their approaches:

A high touch and empathetic approach to the claim process

Richard thinks that a high touch and empathetic approach to claims, especially when its homeowner’s insurance is very important.

For most people, their house is the most valuable property they own. And more than often, it entails a lot of feelings and emotions too. So if somebody has broken into your house. Do you really want an AI or a chatbot answering the phone?

In this regard, Hippo offers a claims concierge to their client as soon as the claim process begins. Their customers are assigned to dedicated person with cell phone number that are available 24-7.

And if the customer has any questions throughout the claims process, they know they have an advocate that is there. And this person will make sure you understand the process and you’re being taken care of.

Go before and beyond the insurance coverage

What’s more, Hippo would reach out to their customers in a proactive way even before a claim exists. Let’s look at another example .

When California wildfires hit, Hippo have an electronic feed from the state that lets them know where the active fires are. And they overlay that feed with where their customers are.

And if they saw customers in harm’s way, they reached out to them proactively and let them know that there’s a fire approaching. Or if they’re very close to an evacuation zone, Hippo would let them know what they need in the event that they get evacuated.

For instance, what they should do should they need a place to stay, or have a claim.

It’s that proactive, empathetic, high touch experience that they think blends the worlds of human and insurance and technology.

Building Block 4 – Building Trust With Customer As A New Brand

“When we first started, we thought that all they needed was an address and that we would automatically give a price. The customer would buy the policy. It would all be done online. There would be no human involvement unless they had a claim and it would move through that process very quick and easy.” Richard recalled.

But that’s not how their customer wants it. They are not necessarily trusting a new brand. In response to that, Hippo did a 2 major changes:

1. Be transparent right up front

Consumers were still used to the experience of spending an hour on the phone with an agent asking a hundred questions. They thought it makes make sense to get a quote the next day with a instead of a real time solution. So, they are not sure when they get an instant quote just by entering an address on a website.

What Hippo learned from there was to share and display the information they got from the data sources. This would get the customer more comfortable with the process behind.

They realized they needed more involvement with the customer, not just some black box rating algorithm that made it happen in 20 seconds.

2. Bring back the human touch

They started with the idea that this would be a mono-channel distribution model – direct to consumers online only. But they learned very quickly that some customers still want to talk to people during the course of their buyer’s journey.

Thus, they set up a call center in Austin, Texas with licensed insurance agents that understand what it’s like to have a home, to have homeowner’s insurance and stand ready to assist the customers.

Building Block 5 – Creating Products That Customers Want

Building something easy to use

In everything they do, Hippo try to make it easy for the customer.

We are easy, we are friendly and we take care of them at time of loss.

Richard McCathron

“Now behind the scenes, we have all the insurance intelligence that every other insurance company has. We get all the data. We make sure that the policies are priced properly. We have a sophisticated by-peril rating algorithm, all of the sort of insurance lingo that people talk about. ” Richard said.

Putting customers’ interest first

When Hippo first started, they wanted to give their customers choices by having slide scales that people could slide their limits from one side to the other.

But they learned that most people don’t know much about homeowner’s insurance. And the last thing they wanted was to motivate people to be under-insured.

Later they changed that approach and put some coverages that other insurance companies only add if requested automatically into our policy.

“We try to make sure that we are providing the coverage people need. And oftentimes they don’t know, so we help them through that process.” Richard said.

Conclusion: What Incumbents And Insurtech Can Learn From Hippo’s Success

Insurance companies still aren’t very good at listening to customers. Some are better than others. Some do an exceptional job, but others still call the customer a policyholder.

They don’t look at them as a customer. In fact, some insurance companies look at the agents as a customer, as opposed to the homeowner.

“You have to be open-minded.”

Richard said.

Richard thinks that it is so very important for us to realize as an industry that the world has changed, the paradigm has shifted.

Insurance customers’ expectations are now in par with Amazon-like experience. If you don’t take the customer-centric approach, some body else will.