You’ve probably had this idea of selling insurance online for some time – either treating it as a side income or gradually making it full-time. You know people are doing it but don’t exactly know where and how to start, how much you can earn, and so on. If that’s what you are wondering, you’ve come to the right place.

In this post, I will focus my discussion on how a salesperson can add value through an insurance sale process with online interactions.

And for the interest of your time, I will not get into the details of the digital marketing aspects of building websites, managing your social accounts, PPC, and the like. Yet I will provide links to the related blog posts for your reference.

Also read:

Can You Sell Health Insurance From Home? (With or Without a License)

Can You Sell Insurance From Home? (Average Income Included)

Can You Sell Pet Insurance Online, From Home or Part-Time? (Earnings Included)

The tactics for selling online

New technology and the abundance of information have given new life to the insurance industry. Many carriers are ramping up their capabilities to facilitate the sales process to cater to a smoother user experience.

Therefore, when it comes to selling insurance online, it’s very important to have the right mentality and to use available resources out there to your advantage. Here are a few points worth noting before you start:

Be an educator to add value – Nowadays, your client can get instant quotes, compare coverages and read user reviews with a few clicks online. A streamlined online application process has made the direct-to-customer model more and more popular.

But to many people, insurance is rather confusing. If you can explain the terms and coverage in the language they can understand, you will add value to your customers during the course of their purchase.

Learn digital marketing – Instead of knocking from door to door, digital marketing allows you to reach more prospects at scale. The best thing is that you can even be laser-sharp to target a specific segment of prospects.

For instance, if you want to reach a younger audience to sell life insurance, you may use TikTok or YouTube. Or if you sell pet insurance and want to place an ad on Facebook to target pet owners in a specific state or age group.

I could write a website on digital marketing for insurance (actually, this happens to be exacting what I’m doing), if you are interested to learn more, read the following posts:

- How to Generate Insurance Leads From Facebook?

- Best Digital Marketing Ideas for Insurance

- How to Market Insurance to Millennials Online? (8 Tips You Must Know)

- How to Market Insurance to Gen Z

- 8 Facebook Marketing Mistakes Insurance Agents Should Avoid (and How to Fix Them)

Leverage available content and resources online – While many digital marketing agencies would advise you to build your own website, post regularly on your social accounts, start a YouTube channel, create a podcast and all that, I think it’s very easy to get overwhelmed especially you are on your own.

Think about the educator role. A teacher may not always need to develop the course material if it is already available out there. Therefore, you could consider using available resources online to start with.

Websites to learn about insurance:

Investopedia.com (personal lines)

Investopedia has dedicated sessions on insurance. Check out informative articles about various types of insurance for individuals, including life, auto, home, travel, health, and more.

Investopedia.com (commercial Lines)

If you want to learn more about commercial/corporate insurance and the different kind of risks involved, Investopedia also has your back.

This is a treasure I’ve recently discovered. I love to use their insurance dictionary. You can find the definition of just about any insurance terms you come across. This is a great resource to educate your customers.

The insurance section from The Balance is one of my go-to resources. It explains how insurance works in plain language that most people can understand. They also have reviews of the most popular insurance companies, guides on filing claims, and tips on how to save money on different types of policies.

Know your competition – With insurance comparison websites and review websites, it has never been easier to know your competition. And if you don’t keep an eye on it, your customers will.

These tools will get you prepared to answer questions like:

- How do your policies compare to the others?

- Why are they cheaper?

- Can you provide a better offer?

More than often, if your prospects are comparing policies with different companies, your understanding of your competitors’ offerings will help you respond to their objections better.

Online insurace comparison websites:

Online insurance reviews websites:

- Reviews.com

- ConsumerAffairs.com

- Clearsurance.com

- SuperMoney.com

- Petinsurancereview.com

- CanineJournal.com

Share stories with a human touch – At the end of the day, insurance is a people’s business, it entails emotions, feelings, and relationships.

On the other hand, you should always share good stories that demonstrate how insurance help customers to overcome their difficult times.

For example, you can share how health insurance help to save someone’s life in critical times. Or you may tell stories of how pet insurance gets a dog the treatment on hip dysplasia otherwise he would have been put to sleep.

Which kind of insurance is the best for selling online?

I would argue health insurance is one of the best lines of business to be sold online. Why? Here are a few reasons:

- There is a constant demand: Everybody needs health insurance. Some state governments will penalize you if you go without health insurance for over three months.

- It is a complicated product: Health insurance has a lot of medical terms and conditions involved. And everyone’s situation is different. An insurance agent can help to explain those technical terms so the customer will be able to understand what is and what is not covered.

- It’s a high-ticket product: The average annual premiums in 2019 are $7,188 for personal coverage and $20,576 for family coverage. Premiums of health insurance have been on a steady rise by 4-5% per year. (Source) It is an investment that people will spend some time researching on. The higher the premiums, the more you can earn from it.

- The one-to-many potential: Parents choose plans for their underage kids. And middle-age adults may also need to help their senior parents to find suitable plans as well. So if your audience falls in the age group of 30s to 50s, they are likely to get quotes and shop for their family.

If you want to learn more about how to earn money with insurance affiliate programs, check out my post on: What Is the Best Insurance to Sell Online?

How much can you earn selling insurance online?

There are two ways you can earn income by selling or promoting insurance online:

- Selling Insurance Online Job (Full-Time)

According to ZipRecruiter, as of May 16, 2021, the average annual pay for a “Selling Insurance Online Job” in the United States is $57,450 a year.

As an online insurance agent, your duties are to sell insurance policies to customers or help an existing customer to update or renew their benefits or insurance package.

Your responsibilities include sourcing and nurturing leads, explaining different types of insurance coverages, and helping customers to complete different types of application forms and documentation.

2. Through Affiliate Program (Part-Time / Passive Income)

A commission can be earned if you promote insurance through affiliate programs by referring traffic for a quote or an application to a carrier’s website.

For instance, the commission for health insurance can range from $5-$16 per lead or up to $162 per sale.

Related posts:

Best Health Insurance Affiliate Programs: How Much Can You Earn?

Best Life Insurance Affiliate Programs: How Much Can You Earn?

Best Pet Insurance Affiliate Programs: How Much Can You Earn?

Let’s do an estimation. If you could send 2 prospects for a quotation per day, you will earn an average of $630 ($5+$16 / 2 x 30 days x 2 quotes) per month. Say, if one out of ten converts, you will have six sales and earn up to $972 per month.

That adds up to $1,602 per month or $19,224 a year.

If you would look at this as a side-hustle that may get you passive income while you are sleeping, at the same time having a full-time job, that’s not bad at all.

Navigating your client through the sales funnel

I understand most of you, especially when buying leads, are anxious to close that sale. But I bet not every lead that comes through will be a ready-buyer right out of the box.

Insurance usually entails a longer sales cycle (as long as months). By understanding which stages your prospects are in, you will have a clear idea of how to make your sales pitch more effectively.

What is a sales funnel? It is a series of steps salespeople follow to take a prospect from being an early stage lead to a paying customer. Check out this short video (1:47) to understand how it works:

The four phases of an insurance sales funnel

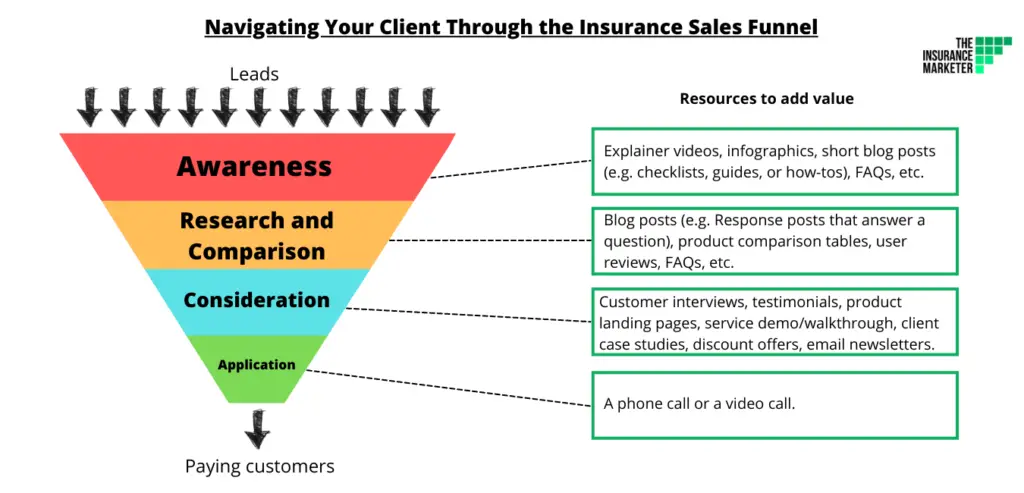

To tailor for the context of selling insurance online, l will divide the sales funnel into four phases. And they are in order of:

- Awareness Phase

- Research and Comparison Phase

- Consideration Phase

- Application Phase

Next, I will walk you through each phase and discuss how you could add value by helping your prospects to move forward to the next phase. Here we go!

| The phase of an insurance sales funnel | Customer goals | Resources to add value |

| Awareness Phase | To understand how an insurance plan works for his/her situation. | Explainer videos, infographics, short blog posts (e.g. checklists, guides, or how-tos), FAQs, etc. |

| Research and Comparison Phase | The main goal of your prospect is to research for and compare different options in the market. | Blog posts (e.g. Response posts that answer a question), product comparison tables, user reviews, FAQs, etc. |

| Consideration Phase | To choose the best among the narrowed options. | Customer interviews, testimonials, product landing pages, service demo/walkthrough, client case studies, discount offers, email newsletters, etc. |

| Application Phase | To get the application form filled as quickly as possible and get covered. | A phone call or a video call. |

Awareness Phase

The awareness phase begins when a prospect realizes or starts to realize he/she has the need to shop for insurance.

They may land on your sales funnel from a lead generation company, a quotation form on a website, or through social media ads. They have just entered the top of the funnel and usually not ready to make a purchase yet.

The main goal of your user is to understand how an insurance plan works for his/her situation.

Questions they may have:

- Where should I start?

- How does health/life/home/pet insurance work?

- What is covered and what is not?

- What are my options?

- How much should I spend?

If these questions are well addressed, you remove their obstacles and let them move forward to the next phase of the funnel.

You should concentrate on answering their questions in this phase to show your expertise. In return, you will gain the trust of your prospect and start to build a relationship.

How to do it?

Again you can leverage the content already available online. Short-form content that answers their questions directly will do the job well:

- Explainer videos

- Infographics

- Short blog posts (e.g. checklists, guides, or how-tos)

- FAQs

Check out these examples from online insurers:

- Health Insurance 101: A Comprehensive Guide to Health Insurance – eHealth Insurance

- Your Guide to Open Enrollment [Video] – Oscar

- How To Baby-Proof Your Health Insurance Checklist – GoHealth

Research and Comparison Phase

This is the information-gathering phase. A prospect is going to consume longer forms of content to get a better understanding of your brand, your products, and your service.

The main goal of your prospect is to research for and compare different options in the market.

They may go to search engines, insurance comparison websites, insurance review websites, online forums (e.g Reddit, Quora, Facebook groups, etc) to look for more information.

Questions they may have:

- What aspects should I be looking for in a plan?

- What will affect the premium?

- Are insurance comparison websites legit?

- Should I buy on price?

How to do it?

As the prospect is trying to weighing different brands, you should try to nurture and engage with them by providing additional information about their products and services.

Here are some tactics you can follow:

- Highlight your unique selling point (e.g. What do you do the best? What differentiate your offerings)

- Relate how the plan works for the prospect’s situation in particular. For example, it does not require a medical exam.

- Share more in-depth content to save your prospect’s time. Examples may include product comparison tables, user reviews and FAQs.

Consideration Phase

Also known as the “evaluation” phase, here your prospects narrow down their selection to 2-3 brands. They know these brands can solve their problem or provide what they need.

The main goal of the prospect is to choose the best among the narrowed options.

Questions they may have:

- What is covered and what is not in a plan?

- Should I really buy online or through an insurance agent? What’s the difference?

- How do I know if an insurer actually pays out claims?

- Is their CS helpful?

- What kind of support do I get if I need to file a claim?

- How long does it take to get reimbursed?

- Can I appoint someone else to take care of my claim if I get really sick?

How to do it?

As a rule of thumb, give them a human touch and make communication channels available. You can offer to answer their questions via a phone call or video call.

Moreover, you may share with your client some BOFU (bottom-of-funnel) content to facilitates the conversion, example may include:

- Customer interviews

- Testimonials

- Product landing pages

- Service demo/walkthrough

- Client case studies

- Discount offer

- Email newsletters

Continue to build the relationship if the prospect is not ready to convert at one time. You can continue to keep in touch with your prospects as an educator with insurance tips or even discount offers.

Application Phase

Congratulations! Your prospect has made up his/her mind and decided to do business with you.

With the application phase, the prospects will become your customers by filling out the application forms and completing the payment.

The main goal of your customer is to get the application form filled as quickly as possible and get covered.

Questions they may have:

- How long will the process take?

- What kind of health information will they ask?

- Do I need a medical examination to qualify for the coverage?

- What’s the next step after I submit my application?

- Under what circumstances will my application be declined?

- What are the payment options?

- Is there any discount?

How to do it?

You should continue to be helpful and resourceful by answering any questions they may have in this phase. Here are a few points to keep in mind to provide your customer a better user experience:

- Make it simple and don’t let the customer think too much

- Set expectations: state clearly how long will the application take and how many steps are there in the process

- Be ready to get on the phone or make a video call to guide your customers through the entire process

Conclusion

Hopefully, by having a clear picture of how the insurance sales funnel works, you can effectively address your customers’ questions in every phase they go through when choosing the right coverage.

Remember insurance usually has a longer sales process. You stand a better chance of winning your customer by solving their problems and helping them make better decisions.