Since the outbreak of the coronavirus pandemic, many businesses have closed their offices and have asked their employees to work from home. With the need for social distancing and lockdowns, it has become a challenge for insurance agents to conduct face-to-face sales meetings like they used to be.

In general, you can sell insurance from home as long as you are licensed to do so in your state. The average annual income for a “Licensed Insurance Agent Work From Home” in the US is $64,435. The most common insurance to sell is auto insurance, home insurance, life insurance and health insurance.

Why selling insurance from home?

COVID-19 has forced a lot of us to stay home. People are getting more used to having online interaction and buying online. Carriers are also ramping up their online systems to cater to remote selling.

Selling insurance from home has these benefits:

- Save you time from commute or traveling to and from the client’s location

- Save you gas by driving less

- Save you mileage on your car insurance (if you use UBI insurance)

- Let you serve more clients who may be far away from you

Who could sell insurance from home?

Although there is no educational requirement for being an insurance agent/broker, you may do better than the others if you like to compare prices, read online reviews, and interested in promoting business online.

People magnets: Obvious enough, you draw people’s attention and they listen to you. And if you have topics to talk about life, health, or pets, you are a good fit. I can imagine you will be telling stories or sharing experiences they people love to hear – over the phone, via video calls, with videos and the like.

Veteran insurance agents/brokers: Your knowledge and background in insurance, as well as your life experience, will certainly differentiate yourself. Young agents may not be able to identify the insurance need beyond their age group. That’s where you can become more relatable in your pitch.

Online niche experts: If you are already in a niche, such as health and fitness, sports, pets, cars, travel, or life coaching, your followers will need insurance too. And why not leverage this relationship you already have and create a new stream of income with insurance?

What kind of insurance can I sell from home?

There is literally no differentiation for the insurance that you can sell from home or in person. Here are the most common insurance categories for individuals you may consider.

- Auto insurance

- Homeowners / Renters Insurance

- Life insurance

- Annuities

- Medicare

- Health insurance

- Cancer insurance

- Pet Insurance

- Business insurance

What kind of license do I need to sell insurance from home?

You will need a license to sell insurance whether you are working purely from home or not. Different lines of insurance products will require different licenses.

The most common licenses and the types of insurance products one are allowed to sell are:

- Property and Casualty Insurance License – Auto Insurance, Homeowners Insurance, Renters Insurance, Business Insurance, Pet Insurance, etc.

- Life and Health Insurance License – Life Insurance, Annuities, Medicare, Health Insurance, etc.

ALSO READ:

To be eligible for applying for a license, you must complete the approved line of prelicensing education and pass the state licensing exam.

For instance, each line of authority in California requires twenty (20) hours of pre-license education. This means that if you wish to get a Property and Casualty license, you must take forty (40) hours of pre-licensing, and for Life, Accident, and Health you must also take forty (40) hours. (Source)

The fee for an online application is $188 per combined line. If you wish to get your Property & Casualty AND your Life, Accident, & Health licenses, you will need to apply for each license separately, and pay the $170 fee each time. (Source)

Can you sell insurance in a state you don’t live in?

When a person is licensed by the state in which they intend to sell life insurance, that license is their “Resident License” only. It allows for the sale of insurance in the state that it was issued in, but only in that state.

If you intend to sell insurance in another state, you must obtain a “Non-Resident License” for that particular state.

You can apply online by going to the National Insurance Producer Registry (NIPR) website for most states. To apply, you will need your resident state license number and your national producer number (NPN).

How much can I earn selling insurance from home?

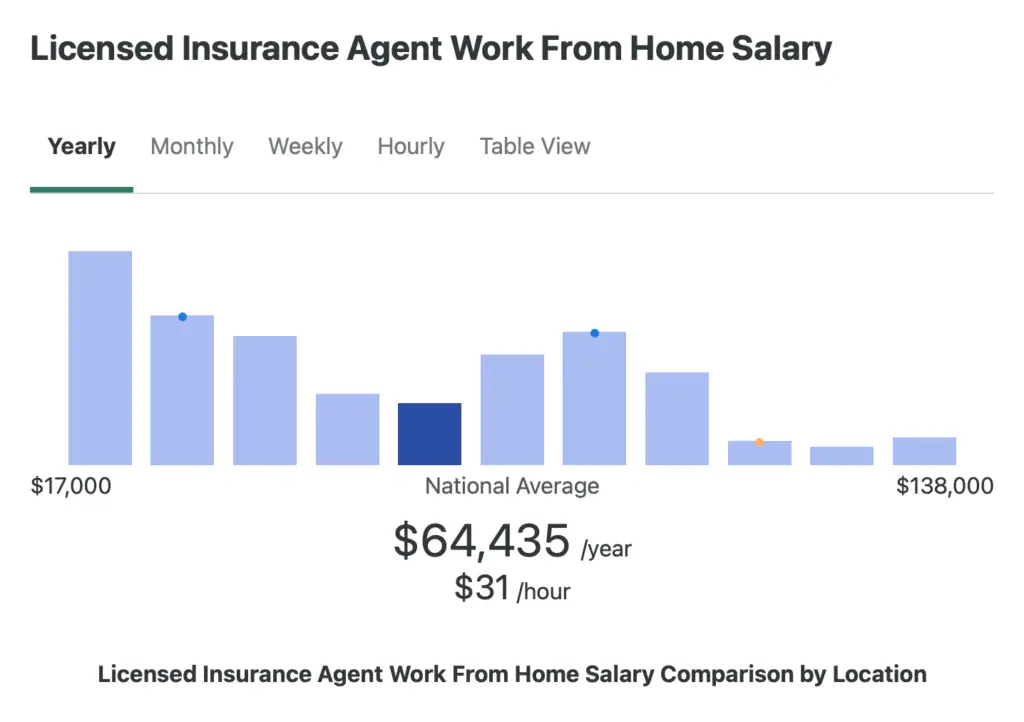

According to ZipRecruiter, as of May 1, 2021, the average annual pay for a “Licensed Insurance Agent Work From Home” in the United States is $64,435 a year.

While annual salaries are as high as $138,000 and as low as $17,000, the majority of Licensed Insurance Agent Work From Home salaries currently range between $31,500 to $89,000.

What’s Next?

At the end of the day, insurance is all about people, feelings and emotions. While being in front of clients works best across all businesses, the reality is this isn’t always an option. Selling insurance from home could be the next big thing.

If you love to help others, enjoy telling stories, and like the idea that insurance can provide a safety net during some of the most difficult times of your fellows, you may consider selling insurance from home.