What is Newsjacking?

Newsjacking is a tactic of injecting your ideas into a breaking news story in order to generate media attention, leads, and awareness.

The term “newsjacking” was coined by David Meerman Scott who wrote the book on Newsjacking: “The New Rules And Realities Of Sales And Marketing” (source: Newsjacking.com)

Between social media, 24-hour news channels, and real-time updates newjacking has become a very effective way to get your name and brand out there.

Why Newsjacking is Relevant for Insurance Marketing?

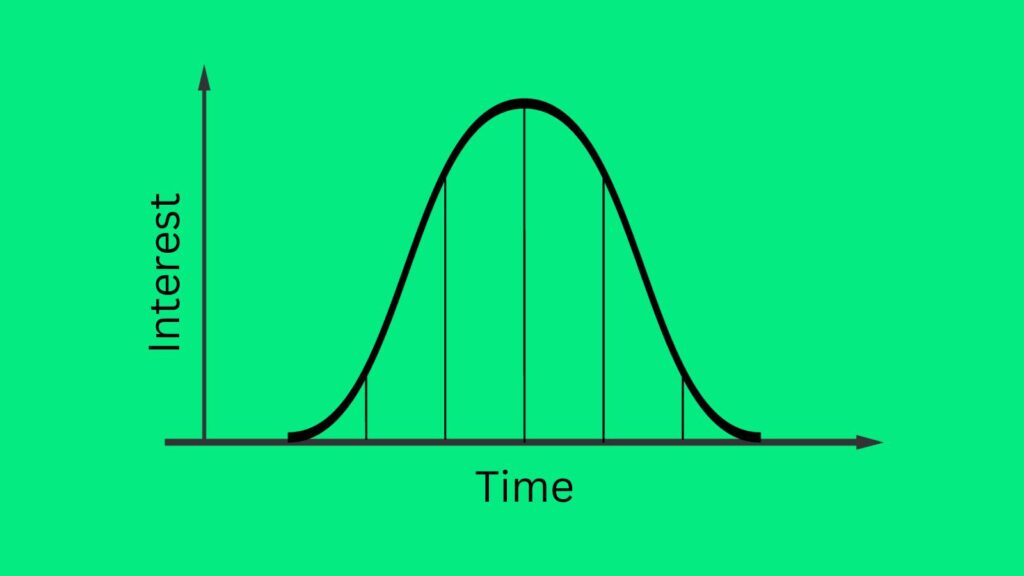

The speed at which news stories develop and spread is rapid. News stories follow a bell curve of interest. Interest will peak and then diminish quite quickly.

The goal is to get your message out there early enough in the news cycle to have a massive impact to generate leads.

When an event occurs – a natural disaster, a major policy change, or a new technological breakthrough – people immediately seek to understand its implications and, often, how it might affect their well-being.

For industries like insurance, which inherently deal with risk management and unforeseen events, these rapid news cycles present opportunities for a newsjacking campaign.

By newsjacking, insurance agents can position themselves at the forefront of these conversations.

Below are some of the main benefits.

Benefits of Newsjacking for Insurance Agents:

- Enhanced Visibility:

- By tapping into trending topics, agents can increase their reach, ensuring that their content is seen by a wider audience actively engaged with current events.

- Positioning as Thought Leaders:

- Offering insights on contemporary issues can position insurance agents as industry experts. Over time, this can build credibility and foster trust among clients and prospects.

- Engagement and Interaction:

- By addressing real-time concerns and interests, agents can foster deeper connections with their audience. This not only boosts engagement metrics but can also pave the way for meaningful conversations and potential leads.

- Cost-Efficiency:

- Since it leverages existing news stories, there’s little to no cost involved in terms of content creation.

- Boosted SEO and Social Media Presence:

- When content aligns with trending topics, it can enjoy enhanced search engine visibility. Coupled with social media shares, agents can benefit from organic traffic surges without extensive paid promotions.

- Opportunity for Direct Feedback:

- Newsjacking often spurs discussions and interactions. This direct feedback from the audience can provide agents with insights into their clients’ concerns, questions, and needs.

Tools for Effective Newsjacking:

Here is a list of tools that range in different prices to help stay on top of trends for newsjacking:

- Glimpse: Analyzes hundreds of millions of data points around consumer behavior signals. This can be a great tool to spot trends others might miss that are relevant to your insurance niche.

- BuzzSumo: BuzzSumo monitors content trends across all social media platforms.

- Google Alerts: An easy-to-use free service where you can set up alerts for certain keywords relevant to your insurance niche.

Tips for Insurance Agents looking to use Newsjacking

For insurance agents eager to employ newsjacking in their marketing and outreach strategies, here are some key tips to make the most of newsjacking:

- Stay Updated on Current Events:

- Regularly check news aggregators, set up Google Alerts for industry-relevant keywords, and follow influential figures on social media.

- Understand Your Audience:

- Know the concerns, questions, and needs of your target audience. This will guide you in selecting the right news to jack and ensuring your content resonates.

- Act Swiftly, But Thoughtfully:

- Timeliness is crucial in newsjacking. However, quick reactions shouldn’t come at the expense of quality or sensitivity.

- Ensure your content provides genuine value, rather than just capitalizing on a trend.

- Integrate with Existing Services:

- Tie the news back to the services or policies you offer. For instance, if there’s a surge in home burglaries in an area, provide insights on the situation and relate it back to homeowners’ insurance.

- Be Cautious with Sensitive Topics:

- Many opportunities for newsjacking in the insurance space involve tragedies or controversies. The goal is to approach the strategy with helpful information not spread misinformation or misleading your audience.

Examples of Newsjacking in the Insurance Industry

- Natural Disasters and Coverage Clarifications:

- After significant hurricanes or earthquakes, some insurance companies have promptly released articles and social media posts explaining the nuances of disaster coverage, deductible specifics, and claims processes. This not only provides valuable information to those affected but also positions the company as a responsive and caring entity during trying times.

- Technological Innovations and Policy Adjustments:

- When self-driving cars started making headlines, several insurers seized the opportunity to discuss the potential implications for auto insurance, including how policies might adapt and the potential risks and benefits of autonomous vehicles.

- Health Outbreaks and Travel Insurance:

- During the onset of the COVID-19 pandemic, numerous travel insurance providers used newsjacking to explain how their policies addressed pandemics, trip cancellations, and medical emergencies abroad.

- New Legislation Impacting Insurance:

- When governments introduce new regulations or reforms that impact insurance – such as changes to healthcare laws or auto insurance reforms – proactive companies quickly produce content breaking down what these changes mean for policyholders.

- Economic Fluctuations and Life Insurance:

- In times of economic downturns or stock market crashes life insurance providers have highlighted the stability and long-term benefits of life insurance as an investment, contrasting it with the volatility of other financial instruments.

- Celebrity Incidents and Insurance Lessons:

- If a celebrity’s house gets burglarized or they face a high-profile accident, some insurers use such events as a springboard to discuss the importance of proper coverage, using the celebrity incident as a relatable case study.

- Seasonal Tips and Timely Coverage:

- Aligning with seasons or events, like providing tips for winterizing homes in cold months or discussing the importance of special event insurance during wedding season, has proven effective for many insurance brands.

- Data Breaches and Cyber Insurance:

- With the rise in high-profile cyber-attacks and data breaches, many insurance companies have newsjacked these incidents to discuss the merits of cyber insurance and how businesses can protect themselves.

These examples underscore how newsjacking, when done tactfully and thoughtfully, can enable insurance brands to enhance their visibility, demonstrate expertise, and connect with their audience meaningfully. It’s about seizing the moment, but always with the intent of adding value and context for the audience.

Conclusion

In an era where digital landscapes shift swiftly and audiences are continuously bombarded with information, staying relevant and capturing attention becomes more challenging than ever.

Newsjacking, as explored throughout this post, emerges as a dynamic tool for modern insurance marketing.

By aligning content with real-time events, insurance professionals can not only increase their visibility but also cement their position as industry leaders who are attuned to the world’s pulse.