Insurance has been around for centuries. But it was not until the latest technology development when its business model started to see drastic disruptions in an unprecedented way.

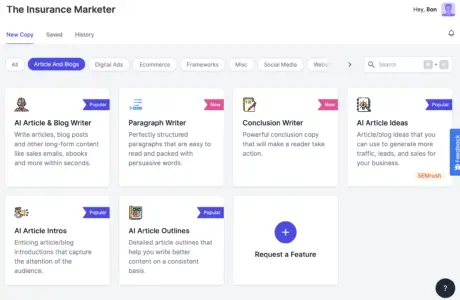

But what are the leading trends in the industry? Insurance is a complex industry, and understanding this new technology can be overwhelming. Luckily, you don’t need to be a data scientist in the field to come up with marketing ideas.

In this article, we will first go through the technology being deployed by insurtech companies and incumbents. Then I will list out 18 important facts and stats on how insurtech is disrupting the traditional insurance business model as well as enhancing the client experience for the better.

What Is Insurtech?

Insurtech is the use of emerging technology, such as artificial intelligence, machine learning, blockchain, and even drone technology to improve and streamline the business operations of the insurance industry as well as helping to improve customer satisfaction across the insurance value chain from product development, marketing, underwriting and claims processing.

Or watch this 3-minute explainer video on “Insurtech explained”:

What Are the Segments of Insurtech Utilized by Insurance Companies?

Some of the common segments of insurtech deployed by insurance companies include:

- Artificial intelligence – Insurance companies are now using computer software and algorithm that can perform the functions typically associated with humans, including but not limited to speech recognition, image analysis and complex decision-making.

- Machine learning – Insurance companies generate and handle tons of data. Machine learning simplifies the process of data extraction and processing. The data generated can help the company process claims faster, ensure accurate underwriting, detect fraud, predict demand for products, and predict the risk of losses.

- Blockchain – Blockchain offers many insurance applications, including efficient information interaction, simplified claims submission, and improved fraud management. For example, with smart contracts, claim settlements can be achieved in only a matter of hours. (v.s. several weeks or months)

- Robo-Advisors – It is the digital financial advice that provides automated, algorithm-based insurance and investment/wealth management advice – without the need of human financial advisors.

- Internet of things (IoT) – Insurance companies can now use GPS-enabled devices (telematics or mobile phones) to keep track of vehicles and driver behavior, with the data generated transmitted over a secure network in real-time. The data generated can help car insurers to provide more bespoke services to their clientele.

- Drone technology – Drones are useful for property inspections where it’s not feasible to send in a worker. They can also be used to inspect accident sites.

ALSO READ:

Here are 18 Important Facts About Insurtech:

1. The global insurtech market size was valued at USD 2.72 billion in 2020.

It is expected to expand at a compound annual growth rate (CAGR) of 48.8% from 2021 to 2028. The increasing need for digitization of insurance services is expected to propel market growth.

2. Global insurtech funding hit at record high in 2020 at $7.12 billion.

It was raised across 377 deals this year, and Life & Health insurtech will further accelerate funding in 2021.

3. Insurtech funding in the US has increased 60% in 2020.

It increased from $1.46 billion to $2.44 billion in the last three years.

4. Insurtech accounted for four of the top five biggest IPOs in 2020.

GoHealth Inc. had the largest float at $913.5 million. Root Inc., Duck Creek Technologies Inc. and Lemonade Inc. conducted IPOs with sizes of $654.7 million, $465.8 million and $366.9 million, respectively. (S&P Global Market Intelligence)

5. Companies deploying insurtech solutions can reduce the application processing time by more than 99.9%.

In the face of the COVID-19 pandemic, more consumers are looking towards providers with strong digital capabilities.

6. Insurers spent around $225 billion on their IT departments in 2019.

7. Around one million jobs are expected to be automated in the coming years.

Insurtech is helping insurance companies save money by avoiding duplicate business operations.

8. Around 50-60% of insurance-company back-office operations can now be automated thanks to insurtech.

9. Only 4% of Millenials are interested in working in the insurance sector.

But insurtech is now regarded as a funnel for attracting technically skilled labor to the industry.

10. 41 percent of consumers are likely to switch their insurance companies in favor of a more digitized one. (PWC)

Insurtech is helping companies to attract more clients in the pandemic environment.

11. More than 30% of insurance companies are now using robotic process automation in the claims reviewing process.

12. Insurance companies among the first industry to relying on drones in their day-to-day operations.

Drones are being used to observe land and buildings before embarking on risk and damage assessment for property and farming insurance purposes.

13. Studies expect 95% of interactions between customers and insurers to be powered by chatbots by 2025.

The rise of insurtech has simplified the quoting and claims filing process for both companies and their clients, with more companies deploying technologies like chatbots.

14. Insurance companies can utilize as much as 90% of the data gathered from customers with robust insurtech systems based on machine learning.

Companies without such systems only end up utilizing as little as 10% of the data.

15. By 2020, robo-advisors will account for $1 trillion of assets under management. (Business Insider)

This figure is further forecasted to increase to $4.6 trillion by the year 2022.

16. Top insurance companies are now using gamification to sell insurance products to hard-to-reach demographics like Millenials and Gen Z.

With more than 60% of consumers happy to listen to marketing messages based on this, and we could see more traditional brands adopt this method of marketing in the coming years.

17. The rate of smartphone use behind the wheel may be as high as 60%.

It was an estimation based on 60 billion journeys’ data from 2018, Zendrive – a mobile app that monitors the driving behavior of customers to potentially offer them significant discounts. (The Economist).

18. Fraud is a serious concern that costs the US insurance sector over $40 billion a year.

Al can help detect fraudulent claims by comparing new claims to existing data. Visual analytics can assess auto or property damage based on images and videos and determine if the damage amounts claimed are accurate or not. (Business.com)

Application of Insurtech in the Insurance Industry

Many companies are demonstrating the use of insurtech today. Here is a handful of real applications of how they leverage technology in their business model:

- Lemonade: In claims settlement, Lemonade’s “AI Jim” assesses the claim by cross-referencing home information, compares it to the customer’s policy, runs fraud algorithms, and finally approves or rejects a claim. The whole process takes up to three minutes and is approved within seconds.

- Hippo: They use drone inspection or utilize an app that allows a remote adjuster to take photos and video of a damage. Hippo provides a response to our customers in 5 to 7 days (versus the industry average of 10 days). That’s a turnaround between 30% and 50% faster.

- Beam: This dental insurance company provides customers with a “smart toothbrush” equipped to track the user’s dental habits. The data generated is used to craft bespoke insurance plans for the customer.

- John Hancock: This life insurance provider uses the data generated from wearables and their telematics monitor to work out life insurance policies for their customers.

- Shift Technology: This Paris-based startup has developed an AI-powered solution that can supposedly boast a 75% accuracy in spotting potential fraud, doubling the market standard.

- Zhong An: This is a Chinese online-only company that has been around since 2013. With more than 460 million users, they are a perfect example of insurtech. They have written nearly 10 billion policies in 2019 without any paper trail or any office visits by customers.

- Teambrella: This is a peer-to-peer service where users can cover themselves, vote on reimbursements and premiums, etc. Payments are handled securely via blockchain.

Conclusion

Insurtech is the light of the industry to bring a wave of digital transformation as well as untapped business opportunities. From the facts and data above, it is clear that insurtechs will continue to play a pivotal role in the drive to provide the change customers want to see in the industry.

Blue vector created by vectorjuice – www.freepik.com

Sources

- Geospatial World: The top 5 technologies impacting the insurance industry

- Data Art: Insurance Innovation: 8 Insurance Technology Trends 2021

- Plug and Play Tech Center: Top 10 Insurtech Companies in 2020

- Duck Creek: 11 Insurance Company Technology Trends Transforming the Industry in 2021

- The Balance: What is Insurtech?

- Altex Soft: Insurance Technologies: 13 Disruptive Ideas to Change Insurance Companies with Telematics, Blockchain, Machine Learning, and APIs

- Board of Innovation: Insurance technology trends that are shaping 2020

- Artificial: Five technology trends changing insurance in 2020

- Statista: Insurtech – Statistics & Facts

- Deloitte: Insurance industry drone use is flying higher and farther