In a competitive marketplace (like this today) and with price comparison websites at buyer’s fingertips, an insurer certainly needs more than a better product and lower price to stay ahead of the curve. With 80% of consumers saying they are more likely to make a purchase when brands offer personalized experiences, insurers need to treat customer personalization seriously.

Mckinsey published an article entitled Marketing’s Holy Grail: Digital personalization at scale a few years ago. And in this article, we will based on what we’ve learned from it to discuss how their suggestions can be applied to create a personalized customer experience for the insurance industry today.

What is a personalized customer experience?

Personalized customer experience, also known as one-to-one marketing strategy, was created by leveraging data analysis or/and automation technology to deliver individualized, relevant and contextual experiences to current and prospective customers.

Just like you may tailor a special gift for a good friend or loved ones, with personalized marketing strategy, companies can also tailor experiences based on information they’ve learnt about their prospects and customers.

Approximately 7 out of 10 (69%) consumers would share significant data on their health, exercise and driving habits in exchange for lower prices from their insurers, an increase of 19% from two years ago.

Accenture (January, 2021)

Why do insurance companies need to create personalized customer experience?

With overload of information, today’s consumers are inert to one-size-fits-all content. Personalized customer experience is a win-win strategy for carriers as well as their customers. Here are some of the benefits:

- Improved customer experience: Tailored offers make customers feel their needs are taken care of. They will appreciate and look forward to interacting with your brand.

- Increased ROI: Not only do insurance customer experience leader firms continue to outperform their laggard counterparts, but the margin of outperformance has widened considerably. Source: The Customer Experience ROI Study (Insurance Industry Edition by Watermark

- Improved customer relationships: Personalized content allows insurers to better serve their customers by understanding their needs.

- Higher conversion rate: More personalized offers drive higher conversion with relevant content.

- Increase customer retention: Offering something unique to your customer improves customer loyalty and turns existing consumers into your brand ambassadors

- Increase lead generation: Happy and satisfied customers will certainly advocate your brand and generate more leads than their competitors

Now I hope you are convinced why it’s important to give each of your customers a unique experience, let’s look at how to create a great customer personalization marketing strategy for insurers.

Hand-picked post:

How to Create a Personalized Customer Experience?

In Mckinsey’s article, 4 solid steps were identified for creating successful personalized customer experience at scale in the digital context. Let’s take a look at each one and talk about how to make it work for insurers.

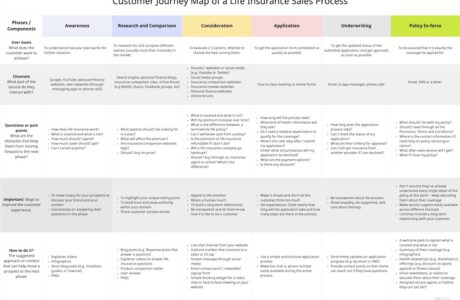

Step 1: Take a journey lens: Use behavioral data to find where the value is

There are actually two tasks in this step. The first is the grouping of customers with similar behaviors and needs. And the second is to understand and segmentize the behavior and anticipate the next purchase according to the customer journey.

Yes, it’s a big step and will need a thorough understanding of the customer journey in the first place. So let’s break it down and see how it can be applied to the insurance industry.

Task 1: Grouping of customers with similar behaviors and needs

Sometimes, the need is quite obvious. These may include someone asking for a quote or downloading a schedule of benefit from an insurer’s website.

But in other times, marketers will need to relate customers’ behavior to different kinds of insurance needs. For example, parents who have a newborn baby may need to consider life insurance to protect their family. Or someone who changed his/her mailing address is likely to have moved into a new house. Thus, there may be a need for home insurance.

We can start by listing out the triggering events related to different kinds of insurance product:

| Type of insurance | Triggering events |

| Life insurance | Having a newborn baby, death of loved ones, acquiring a loan or mortgage, facing a pandemic |

| Health insurance | Reaching a certain age (e.g. 30, 40, 50, 60…or 99!), family or friends admitted to hospital, learning that someone in close contact with was diagnosed with cancer. |

| Accident insurance | Witnessing/being in a an accident, a fire, a storm, a flood or the likes of unexpected situations. |

| Auto insurance | Buying a new car, witnessing/being in a car accident, or after a bad claim experience |

| Homeowner/Renter insurance | Moving into a new home, planning for a DIY home project |

Task 2: Understanding the customer journey

The customer journey for each kind of insurance is not all the same. As we saw from the above, the triggering events and the possible considerations from customers will be different in buying a life insurance policy versus an auto insurance policy.

Therefore, you must take your time to understand the customer journey product by product.

For instance, most people start thinking about homeowner/renter insurance when they start planning to move into a new home. And it has been reported that sales of life insurance increased double-digit (compared to the previous year) during the Covid-19 pandemic, due to the fear of death and greater awareness of the financial risk associated with mortality. (Source)

Step 2: Listen and respond: Plan in advance to react quickly to customer signals

This step requires marketers to pick up signals from customers’ behavior to better understand their needs. The signals can be collected through activities like:

- Their footprint on your website (e.g. page visits, forms downloaded)

- Their engagement (e.g. clicks) from the email you sent

- Their inbound enquiry through email, chatbot or hotline

- Their activity in your mobile app (e.g. location and time)

- Their social media activity (e.g. comments, likes and share on your post)

- Data generated by their wearable devices (e.g. step counts or heart rate)

- Data tracked by telematics (i.e. devices installed in their vehicles)

Marketers will then respond to the signals with relevant and timely messages that are sent to the individual customer. If your customer wants to check his/her coverage, he/she may need to have his/her coverage reviewed and it could be an opportunity for up-sell or cross-sell.

Hand-picked post:

Step 3: Build the war room: Empower a small group of the right people

The article from Mckinsey describes the “war-room team” as carefully selected people, including a campaign manager and staff from creative, digital media, analytics, operations, and IT, plus executive sponsorship at the very top of the organization to remove roadblocks and empower them to get things done.

And yes, the team will act differently and fast – which is rather contrary to the legacy of insurance culture. That’s why they need an executive to cover them up for potential conflicts that may arise.

But in real life situations, you may not always have this much manpower at your disposal. So no matter if you are working solo or with a small team, it is critical to be nimble and able get yourself into the mindsets of different roles. This will help you better navigate your marketing strategies.

Step 4: Rewire and hardwire: Focus on the processes and technology that really help teams work faster

This step is about acknowledging everyone in the organization that the “war-room-team” will be delivering their content at a rapid pace. It’s important to set expectations within the company itself.

Your hotline may get more enquiries from customers who received automation messages. So, proper feedback loops must be created to let the team learn fast based on the customer’s reaction collected from different channels.

The team will also need to be empowered to act on their own to quickly test and iterate different ideas. Mistakes will happen, but leadership needs to be ready to accept that, learn lessons, and move on.

The next thing is to constantly explore marketing automation tools to scale the personalization. It is challenging because not every insurance has the technical know-how to build such tools. So they will need to adapt a learner’s mindset to look out for available tools in the market.

Conclusion

Personalized customer experience is all about treating your customers as individuals. As consumers’ needs and behavior evolve, insurers will need to act fast with scale. This means you have to constantly test, review and learn from your strategies, and adjust available sources to ensure you keep up with their needs.